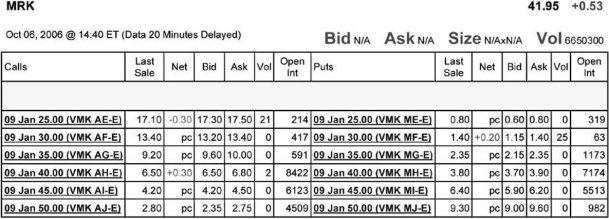

Use the table for the question(s)below.

Consider the following information on options from the CBOE for Merck:

-You have decided to sell (write)five January 2009 put options on Merck with an exercise price of $45 per share.How much money will you receive and are these contracts in or out of the money?

Definitions:

Measurement Date

The specific date at which the values of assets and liabilities are determined in the preparation of financial statements.

Stock Appreciation Rights

A type of employee compensation linked to the increase in the company's stock price over a set period, allowing employees to profit from the appreciation without owning the stock.

Compensation Expense

The total cost incurred by a business for the payment of salaries, wages, benefits, and other forms of compensation to employees.

Options Pricing Model

A mathematical model used to determine the theoretical value of options, taking into account factors like the stock price, strike price, and volatility.

Q5: How many of the January 2009 put

Q9: The amount of cash a firm holds

Q10: Which of the following statements is FALSE?<br>A)The

Q12: The callable annuity rate can be calculated

Q16: Which of the following statements is FALSE?<br>A)If

Q18: Which of the following statements is FALSE?<br>A)The

Q41: Consider the following equation: C = S

Q45: Rose's unlevered cost of capital is closest

Q46: The duration of SFTSL's equity is closest

Q70: Which of the following statements is FALSE?<br>A)The