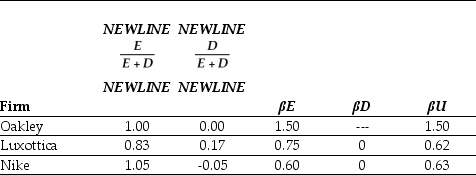

Use the table for the question(s) below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

-If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Oakley is closest to:

Definitions:

Corporate Learners

Employees engaged in ongoing learning and development provided by their organizations.

Role Playing

A training or learning method where participants assume roles and act out scenarios to practice responses, enhance skills, or solve problems.

Trainees

Individuals undergoing training to acquire the skills and knowledge required for a specific job or career.

Behavioural Developmental Strategies

Approaches aimed at enhancing personal growth and adaptability through the modification of behaviors.

Q2: Packaging a portfolio of financial securities and

Q3: The market value of Wyatt Oil after

Q9: Which of the following statements is FALSE?<br>A)With

Q9: Luther Industries is currently trading for $27

Q13: The effective annual rate for Taggart if

Q21: As of June of 2016,Facebook (FB)had no

Q24: Assume that Rockwood is able to repurchase

Q26: Which of the following statements is FALSE?<br>A)As

Q51: The amount of money raised by the

Q74: If Wyatt adjusts its debt once per