Use the table for the question(s) below.

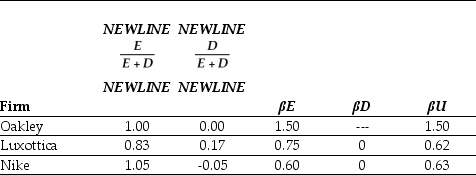

Capital Structure and Unlevered Beta Estimates for Comparable Firms

-If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Oakley is closest to:

Definitions:

Likely

Refers to something that has a high probability of occurring or being true.

Women

Female human beings, as distinguished from men, with reference to social, cultural, and physiological characteristics.

Age Cohort

A group of people who share a similar age, usually born within a specific time frame, and therefore likely to have similar experiences, attitudes, and life stages.

Census Generation

A cohort of individuals born within a specific period, identified or analyzed through census data.

Q10: Which of the following money market investments

Q14: If you are not awarded the government

Q14: The amount that Wyatt Oil pays as

Q21: Which of the following statements regarding the

Q24: Assume that EGI decides to wait until

Q31: Assume that MM's perfect capital market conditions

Q35: Consider the following equation: C = S

Q36: The amount of the increase in net

Q45: Taggart Transcontinental and Phoenix-Durango have entered into

Q45: The lease rate for which Rearden will