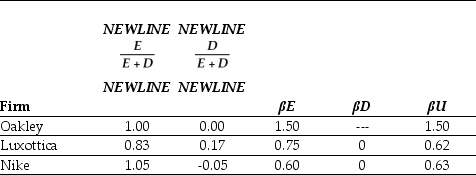

Use the table for the question(s) below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

-If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Nike is closest to:

Definitions:

Hard Enough

A phrase indicating a task or challenge that presents a sufficient level of difficulty.

Lazy

A lack of willingness to work or use energy, often characterized by inactivity and a tendency to avoid effort.

Closed System

A theoretical concept in various sciences referring to a system that does not interact with others systems or its environment, exchanging neither matter nor energy.

Open System

A social system in which status is based on achieved attributes.

Q9: Which of the following statements is FALSE?<br>A)In

Q17: According to MM Proposition 1,the stock price

Q23: An asset-backed security backed by home mortgages

Q37: Which of the following statements is FALSE?<br>A)There

Q42: The amount that Wyatt Oil raised during

Q48: Alpha Beta Corporation maintains a constant debt-equity

Q53: Consider the following equation: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7031/.jpg" alt="Consider

Q64: The WACC for this project is closest

Q80: Assume that capital markets are perfect except

Q97: The number of shares that Galt must