Use the information for the question(s) below.

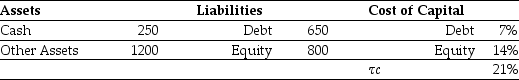

Iota Industries Market Value Balance Sheet ($ Millions) and Cost of Capital  Iota Industries New Project Free Cash Flows (Millions)

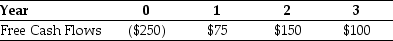

Iota Industries New Project Free Cash Flows (Millions)  Assume that this new project is of average risk for Iota and that the firm wants to hold constant its debt to equity ratio.

Assume that this new project is of average risk for Iota and that the firm wants to hold constant its debt to equity ratio.

-Iota's weighted average cost of capital is closest to:

Definitions:

Financial Accounting Standards Board

An autonomous body tasked with creating and enhancing financial accounting and reporting norms in the United States.

Securities and Exchange Commission

A US government agency responsible for enforcing federal securities laws, regulating the securities industry, and overseeing the nation's stock and options exchanges.

CMA

Certified Management Accountant, a professional certification for accounting and financial professionals in business.

CISA

Certified Information Systems Auditor, a designation awarded to IT auditors who pass an exam and meet specific work experience requirements.

Q5: Which of the following statements is FALSE?<br>A)The

Q22: The value of Shepard Industries with leverage

Q31: Which of the following industries is likely

Q36: Which of the following statements is FALSE?<br>A)By

Q39: The equivalent annual benefit of project B

Q49: Suppose that d'Anconia Copper retained the $200

Q49: Which of the following statements is FALSE?<br>A)When

Q50: The term moral hazard refers to:<br>A)the chance

Q87: Which of the following statements is FALSE?<br>A)The

Q92: In order for Nielson Motors to be