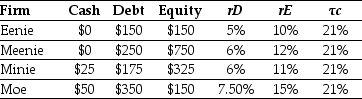

Use the table for the question(s) below.

Consider the information for the following four firms:

-The unlevered cost of capital for "Eenie" is closest to:

Definitions:

Fama And French

Fama and French are economists Eugene Fama and Kenneth French, known for their work on asset pricing models, including the three-factor model that considers market, size, and value factors in portfolio returns.

Regression Coefficient

A number that represents the relationship between a dependent variable and an independent variable in statistical models, indicating the strength and direction of the correlation.

Single Factor Model

A financial model that describes an asset's returns as dependent on a single market index or factor.

Fama-French Three Factor Model

The Fama-French Three Factor Model expands on the Capital Asset Pricing Model by incorporating three factors: market risk, size risk, and value risk, to explain stock returns.

Q2: Based upon the average EV/Sales ratio of

Q20: A lease where the lessee has the

Q22: Which of the following statements is FALSE?<br>A)The

Q24: Nielson's estimated equity beta is closest to:<br>A)0.95.<br>B)1.00.<br>C)1.25.<br>D)1.45.

Q30: Which of the following statements is FALSE?<br>A)Often,the

Q40: The monthly lease payments for a four-year

Q71: Assume that investors in Google pay a

Q71: Which of the following statements is FALSE?<br>A)With

Q77: The NPV of this project using the

Q87: Two separate firms are considering investing in