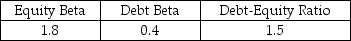

Use theUse the firm has only been listed on the stock exchange for a short time,you do not have an accurate assessment of Nielson's equity beta.However,you do have the following data for another firm in the same industry:  Nielson has a much lower debt-equity ratio of .5,which is expected to remain stable,and Nielson's debt is risk free.Nielson's corporate tax rate is 21%,the risk-free rate is 5%,and the expected return on the market portfolio is 10%.

Nielson has a much lower debt-equity ratio of .5,which is expected to remain stable,and Nielson's debt is risk free.Nielson's corporate tax rate is 21%,the risk-free rate is 5%,and the expected return on the market portfolio is 10%.

-Nielson's equity cost of capital is closest to:

Definitions:

Avoiding Work

An employee’s deliberate attempt to evade tasks or responsibilities assigned as part of their job.

Cognitive Dissonance

Experienced inconsistency between one’s attitudes and/or between attitudes and behavior.

Perceived Control

An individual's belief in their ability to influence or control events in their life, which can impact their motivation and psychological well-being.

Magnitude

The size, extent, or importance of something, often used in the context of measurements or the impact of an event.

Q5: The assumption that the firm's debt-equity ratio

Q7: Which of the following statements regarding municipal

Q15: The weighted average cost of capital for

Q16: Which of the following statements is FALSE?<br>A)The

Q18: The amount of net working capital (in

Q19: Based upon Ideko's Sales and Operating Cost

Q22: Assume that you own 4000 shares of

Q32: If the risk-free rate is 3% and

Q49: If Ideko's loans will have an interest

Q61: Assume that Rockwood is not able to