Use the information for the question(s) below.

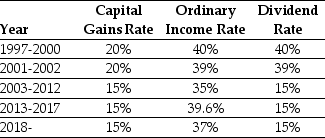

Consider the following tax rates:  *The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

-The effective dividend tax rate for a buy and hold individual investor in 1999 was closest to:

Definitions:

Dispatching

The process of sending off goods or services to their intended destinations or assigning tasks to individuals.

Taxi Company

A business entity that provides transportation services to passengers via vehicles, such as cars or vans, often on a metered fare basis.

Total Quality Management

A management approach focused on continuous improvement of processes, products, and services to enhance customer satisfaction.

Customer Expectations

The set of beliefs or standards that customers hold regarding the future performance and delivery of products and services.

Q2: Packaging a portfolio of financial securities and

Q12: The callable annuity rate can be calculated

Q27: Which of the following statements is FALSE?<br>A)The

Q37: The income that would be available to

Q44: The total amount available to pay out

Q55: Assuming that this project will provide Rearden

Q68: Investors that suffer from a familiarity bias:<br>A)prefer

Q73: Assume that you are an investor with

Q81: Suppose that you are holding a market

Q85: Suppose that BBB pays corporate taxes of