Use the information for the question(s) below.

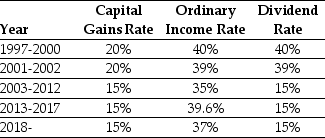

Consider the following tax rates:  *The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

-The effective dividend tax rate for a pension fund in 1999 was closest to:

Definitions:

Shelves

Flat horizontal surfaces used for storing or displaying items, found in cabinets, rooms, or on walls.

File Cabinets

Furniture designed for the organized storage of documents, files, and papers, typically used in office settings.

OUTguides

Tools used in filing systems to track documents that have been removed, typically consisting of a placeholder that records who has taken the document and when.

Barcodes

A machine-readable form of information on a scannable, visual surface that typically represents data about the product to which it is attached.

Q27: In 2005,the effective tax rate for debt

Q32: The total debt overhang associated with accepting

Q38: Consider the following equation: E + D

Q43: If its managers increase the risk of

Q47: The ai in the regression:<br>A)measures the sensitivity

Q67: Consider the following equation: rwacc = <img

Q69: The value of Luther without leverage is

Q70: Suppose that Rearden Metal currently has no

Q88: The value of KD's unlevered equity is

Q94: Considering the fact that Luther's Cash is