Use the information for the question(s)below.

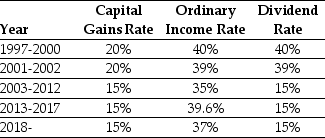

Consider the following tax rates:  *The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket);the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket);the same is true for dividends if the assets are held for less than 61 days.

-Using the available tax information for 2002,calculate the effective dividend tax rate for a:

(1)one-year individual investor

(2)buy and hold individual investor

(3)pension fund

Definitions:

Finishing

The process of completing or refining the final details or surface treatment of a product, often to improve appearance or functionality.

Activities

Tasks, operations, or works carried out in an organization as part of its business processes.

Product Level

Pertains to costs or activities associated with a specific product rather than the business as a whole.

Activity-Based Costing

An accounting method that assigns costs to products or services based on the resources that they consume, aiming to provide more accurate costing information.

Q11: Galt Industries has just issued a callable,$1000

Q32: The income that would be available to

Q47: The cost of _ is highest for

Q49: A(n)_ cash flows come from the cash

Q53: The debt capacity for Omicron's new project

Q62: Suppose the risk-free interest rate is 4%.If

Q76: Which of the following statements is FALSE?<br>A)The

Q79: Which of the following statements is FALSE?<br>A)Real

Q83: If KD expects the share price to

Q85: Suppose that BBB pays corporate taxes of