Use the following information to answer the question(s) below.

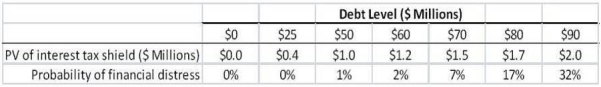

d'Anconia Copper is considering issuing one-year debt,and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt:

-If in the event of distress,the present value of distress costs is equal to $5 million,then the optimal level of debt for d'Anconia Copper is:

Definitions:

Q24: Nielson's estimated equity beta is closest to:<br>A)0.95.<br>B)1.00.<br>C)1.25.<br>D)1.45.

Q31: Which of the following industries is likely

Q43: Which of the following statements is FALSE?<br>A)Many

Q49: Which of the following statements is FALSE?<br>A)The

Q61: Which of the following statements is FALSE?<br>A)Once

Q73: Which of the following statements is FALSE?<br>A)Equity

Q77: Assume that the corporate tax rate is

Q88: Luther Industries has a market capitalization of

Q97: The number of shares that Galt must

Q103: Using the average historical excess returns for