Use the following information to answer the question(s) below.

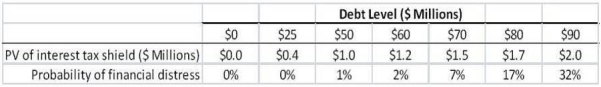

d'Anconia Copper is considering issuing one-year debt,and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt:

-If in the event of distress,the present value of distress costs is equal to $25 million,then the optimal level of debt for d'Anconia Copper is:

Definitions:

Common Stock

This is a type of security that signifies ownership in a corporation and represents a claim on part of the company's profits.

Dividends Payable

The amount of declared dividends that a company owes to its shareholders but has not yet paid.

P/E

Price-to-Earnings Ratio, a valuation metric used to measure a company's current share price relative to its per-share earnings.

Closing Price

The final price at which a security is traded on a given trading day.

Q5: Assume that you own 2500 shares of

Q6: Assuming that this is the venture capitalist's

Q14: The weight on Taggart Transcontinental stock in

Q16: Based upon Ideko's Sales and Operating Cost

Q20: Which of the following statements is FALSE?<br>A)Abandonment

Q37: If investors believe that others have superior

Q73: Which of the following statements is FALSE?<br>A)Equity

Q79: Prior to any borrowing and share repurchase,the

Q92: In order for Nielson Motors to be

Q109: A type of agency problem that results