Use the following information to answer the question(s) below.

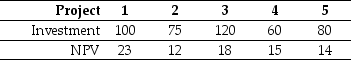

Nielson Motors has a debt-equity ratio of 1.8,an equity beta of 1.6,and a debt beta of 0.20.It is currently evaluating the following projects,none of which would change Nielson's volatility.  (All amounts are in $millions. )

(All amounts are in $millions. )

-Which of the following projects should Nielson Motors accept?

Definitions:

Payroll Taxes

Taxes imposed on employers and employees, based on the wages paid to employees, used to fund social security and other programs.

Corporate Income Tax

A tax levied by governments on the profits earned by corporations and businesses.

Armored Personnel Vehicles

Military vehicles designed to transport personnel and equipment in combat zones, providing protection against ballistic and explosive threats.

Circular-flow Model

A financial framework depicting the ongoing flow of cash, commodities, and productive inputs between businesses and the public within an economic system.

Q2: With perfect capital markets,what is the market

Q6: Which of the following statements is FALSE?<br>A)A

Q25: The correlation between the expected return and

Q34: Which of the following statements is FALSE?<br>A)Nonzero

Q35: LCMS' annual interest tax shield is closest

Q39: Assume that to fund the investment Taggart

Q39: Which of the following statements is FALSE?<br>A)Unlike

Q47: Portfolio "D":<br>A)falls below the SML.<br>B)has a negative

Q49: Which of the following statements is FALSE?<br>A)The

Q87: Which of the following statements is FALSE?<br>A)The