Use the following information to answer the question(s) below.

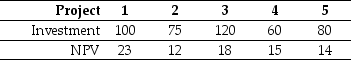

Nielson Motors has a debt-equity ratio of 1.8,an equity beta of 1.6,and a debt beta of 0.20.It is currently evaluating the following projects,none of which would change Nielson's volatility.  (All amounts are in $millions. )

(All amounts are in $millions. )

-In order for Nielson Motors to be willing to invest,project 3 must have an NPV greater than:

Definitions:

Superior Sagittal Sinus

A large venous channel located at the top of the head running along the sagittal suture, draining blood from the brain.

Venous Blood

Blood that is returning to the heart after circulating through the body, characterized by a lower oxygen content and a darker color than arterial blood.

Cerebrospinal Fluid

A clear, colorless body fluid found within the brain and spinal cord, acting as a cushion and providing basic mechanical and immunological protection to the brain.

Pia Mater

The delicate innermost layer of the meninges, the membranes that envelop the brain and spinal cord, providing a protective covering.

Q27: In 2005,the effective tax rate for debt

Q34: Rearden Metal has a bond issue outstanding

Q35: The cost of capital for the oil

Q37: Assuming that Ideko has an EBITDA multiple

Q39: Which of the following statements is FALSE?<br>A)The

Q41: Suppose that MI has zero-coupon debt with

Q51: The market capitalization of d'Anconia Copper after

Q58: Using the FFC four factor model and

Q67: Galt's asset beta (i.e.the beta of its

Q89: The value of Shepard Industries without leverage