Use the following information to answer the question(s) below.

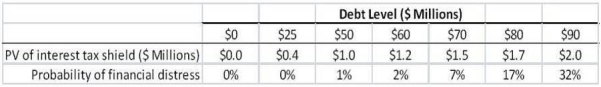

d'Anconia Copper is considering issuing one-year debt,and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt:

-If in the event of distress,the present value of distress costs is equal to $10 million,then the optimal level of debt for d'Anconia Copper is:

Definitions:

Organic Societies

Societies characterized by complex interdependence of parts, akin to organisms, where differentiation of functions exists for the overall wellbeing.

Social Facts

Aspects of social life that exist outside of individuals, such as laws, norms, and values, that influence their behavior.

Social Conventions

Agreed-upon norms and practices that govern behavior within societies or groups.

Language

A system of spoken, written, or gestural symbols used by people to communicate thoughts, emotions, and information.

Q23: The unlevered beta for Blinkin is closest

Q24: Assume that it will cost $1 million

Q26: Which of the following statements is FALSE?<br>A)The

Q46: Which of the following statements is FALSE?<br>A)The

Q51: Which of the following statements is FALSE?<br>A)In

Q59: In 2000,the effective tax rate for debt

Q63: Rearden Metal has no debt,and maintains a

Q70: Suppose that Rearden Metal currently has no

Q78: Consider the following formula: VL = VU

Q79: Which of the following statements is FALSE?<br>A)Real