Use the following information to answer the question(s) below.

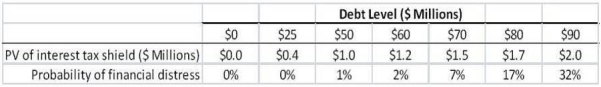

d'Anconia Copper is considering issuing one-year debt,and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt:

-If in the event of distress,the present value of distress costs is equal to $25 million,then the optimal level of debt for d'Anconia Copper is:

Definitions:

Audience's Feelings

The emotions or sentiments experienced by viewers, readers, or listeners in response to a message, performance, or event.

Logical Appeal

A method of persuasion that uses evidence and reasoning to convince an audience of a particular point of view or action.

Human Reason

The capacity of the human mind to analyze, create, deduce, and understand logical connections and facts.

Mobile App

A software application designed to run on mobile devices, created for a variety of purposes from entertainment to business.

Q20: Which of the following statements is FALSE?<br>A)One

Q20: Assume that investors hold Google stock in

Q23: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7031/.jpg" alt="The term

Q34: What range for the market value of

Q40: If Wyatt adjusts its debt continuously to

Q59: In an agency problem known as asset

Q63: Which of the following agency problems represents

Q78: Suppose you are a shareholder in d'Anconia

Q93: If Wyatt Oil distributes the $70 million

Q110: The weight on Lowes in your portfolio