Use the following information to answer the question(s) below.

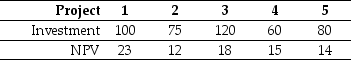

Nielson Motors has a debt-equity ratio of 1.8,an equity beta of 1.6,and a debt beta of 0.20.It is currently evaluating the following projects,none of which would change Nielson's volatility.  (All amounts are in $millions. )

(All amounts are in $millions. )

-Nielson Motors should accept those projects with profitability indices greater than:

Definitions:

Profit Margin

A financial metric expressing the ratio of a company's net income to its sales, demonstrating the percentage of revenue that exceeds the cost of goods sold.

Equivalent Annual Cost

A financial analysis approach to compare the cost-effectiveness of different assets with differing lifespans by calculating their annual costs.

CCA Class

In Canada, Capital Cost Allowance Classes refer to categories under which business assets are placed for the purpose of depreciation calculation for tax purposes.

Maintenance Costs

Expenses incurred to keep an asset in good working condition or to repair it so it continues to operate effectively.

Q14: The amount that Wyatt Oil pays as

Q16: Which of the following statements is FALSE?<br>A)The

Q24: Nielson's estimated equity beta is closest to:<br>A)0.95.<br>B)1.00.<br>C)1.25.<br>D)1.45.

Q38: The weighted average cost of capital for

Q43: If its managers increase the risk of

Q48: Alpha Beta Corporation maintains a constant debt-equity

Q50: Which of the following statements is FALSE?<br>A)If

Q52: Which of the following statements is FALSE?<br>A)The

Q67: The firm mails dividend checks to the

Q97: Consider the following equation: rwacc = <img