Use the following information to answer the question(s) below.

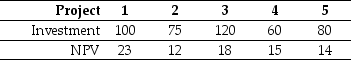

Nielson Motors has a debt-equity ratio of 1.8,an equity beta of 1.6,and a debt beta of 0.20.It is currently evaluating the following projects,none of which would change Nielson's volatility.  (All amounts are in $millions. )

(All amounts are in $millions. )

-If Nielson Motors invests in only those projects which are beneficial to the stockholders,then the total debt overhang associated with accepting these project(s) is closest to:

Definitions:

Subsidiary

A company controlled by another company, referred to as the parent company, through ownership of more than half of its voting stock.

Impairment

The reduction in the recoverable value of a fixed asset or goodwill below its book value on the balance sheet, often leading to an expense in the income statement.

Retained Earnings

Accumulated net income that has been retained by a company rather than distributed to its owners as dividends.

Shareholders

Individuals or entities that own shares in a corporation, giving them ownership interest in the company.

Q8: In practice which market index would best

Q19: The volatility of your investment is closest

Q31: The NPV of this project using the

Q35: Which of the following statements is FALSE?<br>A)Margin

Q36: Which of the following statements is FALSE?<br>A)In

Q44: Assume that Kinston has the ability to

Q53: Which of the following firms is likely

Q56: The alpha for Chihuahua is closest to:<br>A)+2%.<br>B)-5%.<br>C)-3%.<br>D)+3%.

Q70: Wyatt Oil's excess return for 2009 is

Q108: Which of the following statements is FALSE?<br>A)An