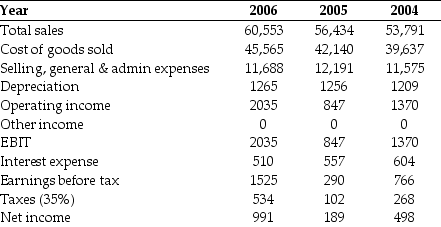

Use the table for the question(s) below.

Consider the following income statement for Kroger Inc.(all figures in $ Millions) :

-The total amount available to pay out to all the investors in Kroger in 2005 is closest to:

Definitions:

Homeostasis

The self-regulating process by which biological systems tend to maintain stability while adjusting to conditions that are optimal for survival.

Middle Childhood

A developmental stage that occurs roughly between the ages of 6 to 12 years, characterized by significant growth in social, cognitive, and emotional domains.

Adolescence

Adolescence is the developmental stage that occurs between childhood and adulthood, typically characterized by physical, psychological, and social changes.

Early Adulthood

This life stage follows adolescence, typically involving individuals aged 20 to 40, characterized by increased independence, career establishment, and often the formation of long-term relationships.

Q6: Which of the following statements is FALSE?<br>A)A

Q22: Wyatt Oil has a bond issue outstanding

Q28: Your firm is planning to invest in

Q30: IF FBNA increases leverage so that its

Q31: Which of the following industries is likely

Q31: IF FBNA increases leverage so that its

Q81: The expected return on the alternative investment

Q105: The Volatility on Stock Y's returns is

Q111: Assume that in the event of default,20%

Q122: The Sharpe Ratio for Rearden Metal is