Use the information for the question(s)below.

KD Industries has 30 million shares outstanding with a market price of $20 per share and no debt.KD has had consistently stable earnings,and pays a 35% tax rate.Management plans to borrow $200 million on a permanent basis through a leveraged recapitalization in which they would use the borrowed funds to repurchase outstanding shares.

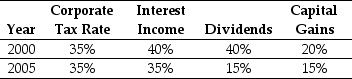

-Assume the following tax schedule:

Personal Tax Rates  Considering the effect of personal taxes,calculate the PV of the interest tax shield provided by KD's recapitalization in 2005.

Considering the effect of personal taxes,calculate the PV of the interest tax shield provided by KD's recapitalization in 2005.

Definitions:

Chemotherapy

A method of treating cancer that involves administering one or more chemotherapy drugs according to a specific, standardized protocol.

Immune Response

The body's defense mechanism against foreign substances or pathogens, involving various cells and proteins.

IgE Antibodies

Antibodies produced by the immune system that play a key role in allergic reactions.

Allergy

An immune system reaction to foreign substances (allergens) that are usually harmless to most people, leading to various symptoms.

Q25: The correlation between the expected return and

Q26: Assume that capital markets are perfect,you issue

Q30: Following the borrowing of $12 million and

Q37: The NPV for Omicron's new project is

Q53: FBNA's EBIT is closest to:<br>A)$33 million.<br>B)$40 million.<br>C)$45

Q53: Which of the following statements is FALSE?<br>A)Options

Q53: Suppose you are a shareholder in d'Anconia

Q63: Rearden Metal has no debt,and maintains a

Q75: Which of the following statements is FALSE?<br>A)Because

Q100: Your estimate of the debt beta for