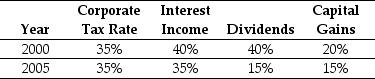

Use the table for the question(s) below.

Consider the following historical top federal tax rates in the United States:

Personal Tax Rates

-In 2005,assuming an average dividend payout ratio of 50%,the effective tax rate for equity holders was closest to:

Definitions:

Sales Dollars

Revenue generated from the sale of goods and services, expressed in monetary units.

Break-Even

The point at which total costs and total sales are equal, resulting in no net loss or gain.

Common Fixed Expenses

Expenses that do not change with the level of production or sales over a certain period and are shared among different segments or products of a business.

Break-Even

The point at which total costs and total revenue are equal, resulting in no net loss or gain.

Q9: Consider the following equation: Dt = d

Q28: Using the income statement above and the

Q31: Do expected returns for individual stocks increase

Q34: Consider the following equation: βU = <img

Q36: What is the efficient frontier and how

Q47: The holder of a put option has:<br>A)the

Q65: Which of the following statements is FALSE?<br>A)If

Q86: Wyatt's annual interest tax shield is closest

Q96: Assuming your cost of capital is 6

Q108: Which of the following statements is FALSE?<br>A)When