Use the information for the question(s)below.

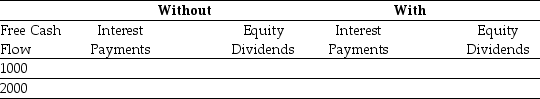

Consider two firms: firm Without has no debt,and firm With has debt of $10,000 on which it pays interest of 5% per year.Both companies have identical projects that generate free cash flows of $1000 or $2000 each year.Suppose that there are no taxes,and after paying any interest on debt,both companies use all remaining free cash flows to pay dividends each year.

-Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows:

Definitions:

Tennis Rackets

Sporting equipment consisting of a handle and an open hoop with a network of strings, used to hit a tennis ball in the game of tennis.

Previous Design

A design or layout that was used or implemented before the current one, often referred to in revisions or updates.

New Racket

New racket typically refers to a freshly introduced or latest model of a sports racket, such as for tennis, badminton, or squash.

Completely Randomized

An experimental design where all subjects are randomly assigned to different treatment groups, ensuring no systematic bias affects the outcomes.

Q5: Assume that you own 2500 shares of

Q10: The effective dividend tax rate for a

Q23: In 2018,Luther Incorporated paid a special dividend

Q44: The Sharpe Ratio for Wyatt Oil is

Q47: Suppose an investment is equally likely to

Q48: Assume that you purchased General Electric Company

Q61: The excess return is the difference between

Q62: Which of the following statements regarding portfolio

Q85: Assume that investors hold Google stock in

Q89: The NPV for this project is closest