Use the information for the question(s)below.

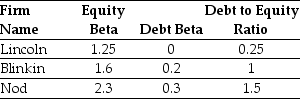

You are evaluating a new project and need an estimate for your project's beta.You have identified the following information about three firms with comparable projects:

-Based upon the three comparable firms,what asset beta would you recommend using for your firm's new project?

Definitions:

Firm Costs

All the expenses incurred by a company in the production and sale of goods or services, including raw materials, labor, and overhead.

Other Goods

Refers to products or commodities that are considered as alternatives or options aside from the primary goods under consideration.

Q4: The alpha for the informed investors is

Q7: Suppose that to raise the funds for

Q20: Consider the following equation: Pcum - Pex

Q28: The expected return on a security with

Q33: Which of the following statements is FALSE?<br>A)Portfolios

Q55: What is a market value balance sheet

Q62: The standard deviation of the overall payoff

Q68: Investors that suffer from a familiarity bias:<br>A)prefer

Q92: The effective tax disadvantage for retaining cash

Q102: If in the event of distress,the present