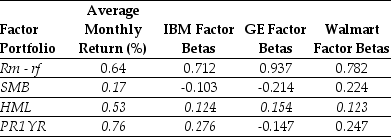

Use the table for the question(s) below.

Consider the following information regarding the Fama-French-Carhart four factor model:

-Using the FFC four factor model and the historical average monthly returns,the expected monthly return for IBM is closest to:

Definitions:

Trial

A formal examination of evidence before a judge, and possibly a jury, to decide guilt in a criminal case or liability in a civil case.

Plagiarism

The act of using someone else's work or ideas without proper acknowledgment or authorization, considered a violation of academic and professional ethics.

Copyright Infringed

A violation of the exclusive rights granted to the creator or holder of copyright, often involving unauthorized use or reproduction.

Academic Dishonesty

Any form of cheating, plagiarism, or unauthorized collaboration by students in an academic setting.

Q11: Assume that you have $250,000 to invest

Q21: The value of Luther with leverage is

Q23: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7031/.jpg" alt="The term

Q25: Which of the following is NOT a

Q26: The volatility of the alternative investment that

Q26: Which of the following statements is FALSE?<br>A)The

Q44: Which of the following statements is FALSE?<br>A)The

Q47: The expected return for Nielson Motors stock

Q84: Consider the following equation: Pretain = Pcum

Q85: Suppose that BBB pays corporate taxes of