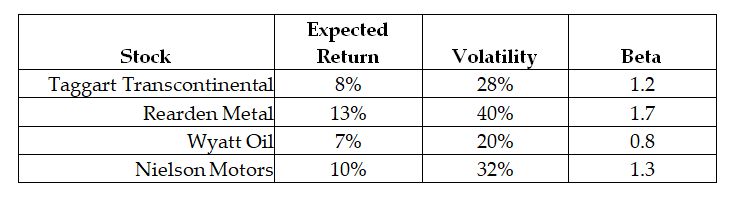

Use the following information to answer the question(s) below.

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New information arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

-The expected alpha for Taggart Transcontinental is closest to:

Definitions:

Endoplasmic Reticulum

A network of membranous tubules within the cytoplasm of a cell, involved in protein and lipid synthesis and transport.

Cytoplasm

The gel-like substance within a cell, excluding the nucleus, containing organelles and is the site of numerous metabolic reactions.

Citric Acid Cycle

A key metabolic pathway that combines acetyl-CoA and oxaloacetate to produce energy through the oxidation of acetyl units.

Primitive Bacteria

Ancient or early forms of bacteria often characterized by simpler structures and fundamental survival mechanisms.

Q17: What alternative investment has the lowest possible

Q59: Suppose that to raise the funds for

Q61: Which of the following statements is FALSE?<br>A)A

Q63: The overall value of Wyatt Oil (in

Q67: Consider the following equation: rwacc = <img

Q67: Suppose that the managers at Rearden Metal

Q67: The tendency to hang on to losers

Q75: Which of the following statements is FALSE?<br>A)Holding

Q81: The expected return on the alternative investment

Q83: The idea that managers who perceive the