Use the following information to answer the question(s) below.

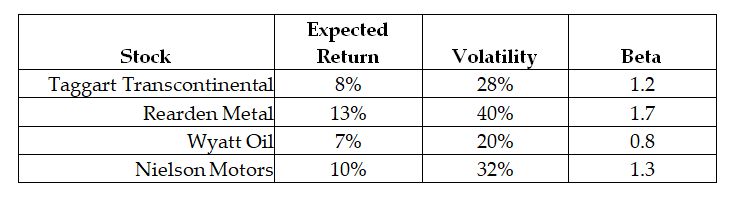

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New information arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

-The expected alpha for Wyatt Oil is closest to:

Definitions:

Communication Barriers

Forces or events that can disrupt communication, including noise and distractions, competing messages, filters, and channel breakdowns.

Social Communication Model

A framework for understanding how information is exchanged and processed in social interactions and media.

Non-Voice Use

Utilization of technology or services that do not require spoken communication, such as texting or email.

Smartphones

Advanced mobile phones that combine the functionalities of a computer, including internet access and the ability to run software applications.

Q40: Which of the following statements is FALSE?<br>A)The

Q43: The value of Iota if they use

Q49: Assuming that Novartis AG (NVS)has a book

Q59: In 2000,the effective tax rate for debt

Q77: The market portfolio:<br>A)is underpriced.<br>B)has a positive alpha.<br>C)is

Q81: The expected return on the alternative investment

Q86: Which of the following statements is FALSE?<br>A)If

Q88: If Wyatt adjusts its debt once per

Q93: The Sharpe ratio for your portfolio is

Q108: Which of the following statements is FALSE?<br>A)When