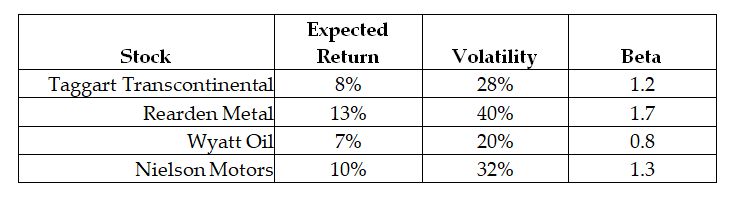

Use the following information to answer the question(s) below.

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New information arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

-Which of the following stocks represent buying opportunities?

1.Taggart Transcontinental

2.Rearden Metal

3.Wyatt Oil

4.Nielson Motors

Definitions:

CourseHours Field

A database or software field specifically designed to record or track the number of hours dedicated to a course.

Data Type

The characteristic of a variable or data element that determines what kind of value it can hold, such as integer, real, boolean, or string.

Input Mask

A method to enforce the format of the input by setting predefined criteria, ensuring data is entered in a specific format.

Compacting Database

The process of reorganizing a database to reclaim unused space and optimize performance.

Q2: Suppose you plan to hold Von Bora

Q12: Which of the following is consistent with

Q13: If Flagstaff maintains a debt to equity

Q25: Which of the following statements is FALSE?<br>A)The

Q28: The expected return on a security with

Q37: Suppose that Luther's beta is 0.9.If the

Q62: The difference between the weighted-average cost of

Q63: Which of the following statements is FALSE?<br>A)The

Q67: The tendency to hang on to losers

Q89: The value of Shepard Industries without leverage