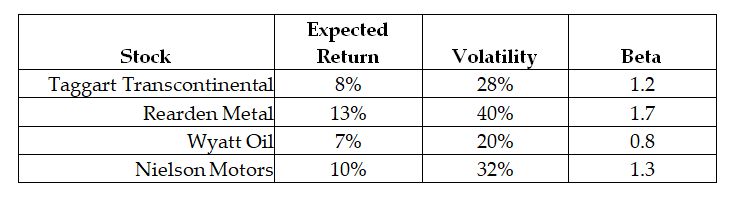

Use the following information to answer the question(s) below.

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New information arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

-Which of the following stocks represent selling opportunities?

1.Taggart Transcontinental

2.Rearden Metal

3.Wyatt Oil

4.Nielson Motors

Definitions:

Genetic Data

Information related to the genes and hereditary characteristics of organisms, often used in research, medicine, and agriculture.

Multiregional Hypothesis

A theory suggesting that human evolution occurred in several geographical areas worldwide, with continuous gene flow between populations.

Gene Flow

The transfer of genetic material from one population to another, enhancing genetic diversity.

Out of Africa Hypothesis

The theory proposing that modern humans originated in Africa before migrating to other parts of the world.

Q18: Galt's WACC is closest to:<br>A)6.0%.<br>B)9.6%.<br>C)11.1%.<br>D)10.7%.

Q28: Which of the following statements is FALSE?<br>A)The

Q33: Given that Rose issues new debt of

Q38: Consider the following equation: E + D

Q58: Which of the following statements is FALSE?<br>A)If

Q62: The standard deviation of the overall payoff

Q63: Rearden Metals expects to have earnings this

Q71: Assume that investors in Google pay a

Q95: You expect KT Industries (KTI)will have earnings

Q114: The expected return on your investment is