Use the following information to answer the question(s) below.

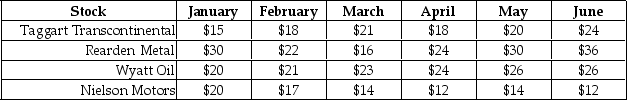

Consider the price paths of the following stocks over a six-month period:  None of these stocks pay dividends.

None of these stocks pay dividends.

-Assume that you are an investor with the disposition effect and you bought each of these stocks in January.Suppose that it is currently the end of March,which stocks are you most inclined to sell? 1.Taggart Transcontinental

2.Rearden Metal

3.Wyatt Oil

4.Nielson Motors

Definitions:

Sex Bias

The unfair difference in treatment or attitudes based on an individual's sex, often leading to disadvantage or prejudice against one sex.

Sex-Role Stereotyping

Sex-Role Stereotyping involves assigning behaviors, tasks, and roles based on societal expectations related to an individual's sex, often leading to limitations and inequities.

Issue of Control

The struggle or conflict surrounding the ability, desire, or need to manage or influence events, outcomes, or actions.

Issue of Power

A concept that refers to the dynamics of control, authority, and influence within relationships, groups, or societies, and how it affects interactions and decisions.

Q1: Suppose that to raise the funds for

Q15: What is the excess return for the

Q41: Which of the following statements is FALSE?<br>A)When

Q43: Which of the following statements regarding recapitalizations

Q43: The market value of Luther's non-cash assets

Q44: Suppose that you are holding a market

Q47: The expected return for Nielson Motors stock

Q77: The market portfolio:<br>A)is underpriced.<br>B)has a positive alpha.<br>C)is

Q82: If Flagstaff currently maintains a debt to

Q86: Which of the following statements is FALSE?<br>A)Many