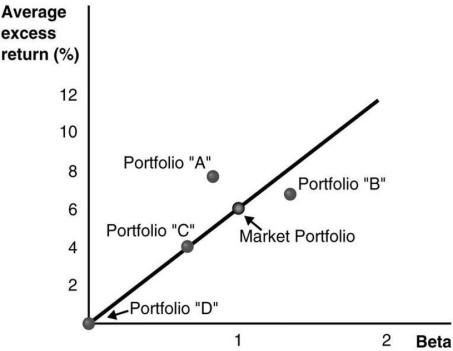

Use the figure for the question(s) below.Consider the following graph of the security market line:

-Which of the following statements regarding portfolio "B" is/are correct? 1.Portfolio "B" has a positive alpha.

2.Portfolio "B" is overpriced.

3.Portfolio "B" is less risky than the market portfolio.

4.Portfolio "B" should not exist if the market portfolio is efficient.

Definitions:

Dual Process Approach

A theoretical framework suggesting that there are two distinct systems for processing information: one that is fast, automatic, and emotional, and another that is slower, more deliberative, and logical.

Reflexive Processes

Automatic, subconscious reactions or processes that do not require deliberate thought, often in response to external stimuli.

Reflective Processes

Cognitive activities involving thoughtful consideration and examination of one's beliefs, actions, and motivations.

Physiological Processes

Physiological processes are the normal functions and activities of the body's systems, including digestion, respiration, and circulation.

Q2: Suppose you plan to hold Von Bora

Q23: A firm's net investment is:<br>A)its capital expenditures

Q32: Net of capital gains taxes,the amount the

Q33: Assuming that the risk-free rate is 4%

Q37: If investors believe that others have superior

Q49: Suppose that to raise the funds for

Q68: Assume that the Wilshire 5000 currently has

Q77: Which pharmaceutical company faces less risk?

Q82: If Flagstaff currently maintains a debt to

Q94: Monsters Inc.is a utility company that recently