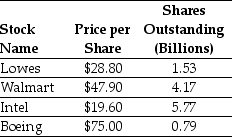

Use the table for the question(s)below.

Consider the following stock price and shares outstanding data:

-Assume that you have $250,000 to invest and you are interested in creating a value-weighted portfolio of these four stocks.How many shares of each of the four stocks will you hold? What percentage of the shares outstanding of each stock will you hold?

Definitions:

Market Price

The current value at which an asset or service can be bought or sold in the marketplace.

Shares Outstanding

The total number of a company's shares that are currently owned by all its shareholders, including those held by institutional investors and restricted shares held by company’s insiders.

Stock Split

A corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares, though the overall value of one's holdings remains the same.

Shareholder Wealth

The total value of a shareholder's equity in a company, taking into account the current market value of shares owned.

Q1: Wyatt Oil just reported that a major

Q6: Which of the following equations is INCORRECT?<br>A)P0

Q23: The Sisyphean Company is considering a new

Q26: When discounting dividends you should use:<br>A)the weighted

Q32: Which of the following statements is FALSE?<br>A)Because

Q33: What is the expected payoff to equity

Q38: Assuming that Casa Grande Farms depreciates these

Q49: Assuming that Novartis AG (NVS)has a book

Q87: Which of the following statements is FALSE?<br>A)The

Q91: Which of the following is unlikely to