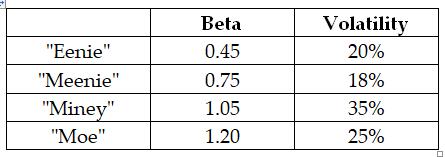

Use the following information to answer the question(s) below

Assume that the risk-free rate of interest is 3% and you estimate the market's expected return to be 9%.

-The equity cost of capital for "Miney" is closest to:

Definitions:

Jung

Carl Jung, a Swiss psychiatrist and psychoanalyst who founded analytical psychology, known for concepts such as the collective unconscious, archetypes, and psychological types.

Spiritualistic Theories

Hypotheses or beliefs that suggest a non-physical realm or spiritual dimensions can influence human behavior and life.

Freud

An Austrian neurologist and the founder of psychoanalysis, known for his theories about the unconscious mind and the development of personality.

Basic Anxiety

Basic anxiety is a term coined by psychoanalyst Karen Horney, referring to feelings of helplessness and insecurity that arise from a hostile environment.

Q22: The Correlation between Stock X's and Stock

Q27: Which of the following statements is FALSE?<br>A)We

Q33: Which of the following statements regarding profitable

Q51: The interest rate tax shield for Kroger

Q51: The market capitalization of d'Anconia Copper after

Q59: Suppose that Rearden Metal made a surprise

Q71: Which of the following statements is FALSE?<br>A)As

Q80: Based upon the enterprise value to EBITDA

Q95: The price per share of Iota if

Q102: If in the event of distress,the present