Use the following information to answer the question(s) below.

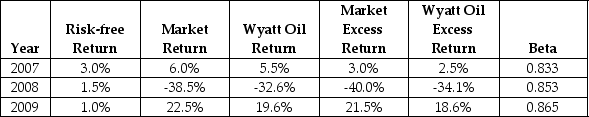

-Using the average historical excess returns for both Wyatt Oil and the Market portfolio,estimate Wyatt Oil's beta.When using this beta,the alpha for Wyatt Oil in 2007 is closest to:

Definitions:

Risky Assets

Assets that carry a significant possibility of loss along with the potential for higher rewards.

Money Market Mutual Funds

Investment funds that pool investors' money to purchase short-term, high-quality debt securities, offering liquidity and earning interest.

Check-Writing Privileges

The ability granted to an individual to write checks against an account, such as a money market account, that typically doesn't offer this feature.

Bank Checking Accounts

Banking services that allow individuals and businesses to deposit money and withdraw funds, typically through issuing checks or electronic transfers.

Q9: Your estimate of the asset beta for

Q12: Which of the following statements is FALSE?<br>A)We

Q20: The expected return for Alpha Corporation is

Q34: Which of the following statements is FALSE?<br>A)The

Q36: Which of the following costs would you

Q45: The expected return for the fad follower's

Q59: The beta for Taggart Transcontinental is closest

Q88: Rearden's equity cost of capital is closest

Q94: Considering the fact that Luther's Cash is

Q95: Which of the following statements is FALSE?<br>A)Even