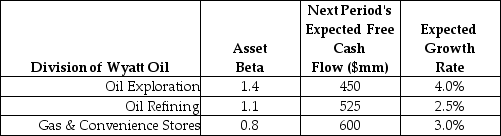

Use the following information to answer the question(s) below.  The risk-free rate of interest is 3% and the market risk premium is 5%.

The risk-free rate of interest is 3% and the market risk premium is 5%.

-The overall cost of capital for Wyatt Oil is closest to:

Definitions:

Economies Experience

Describes the various situations, changes, or conditions that economies undergo over time.

Above-Equilibrium Wage

A wage rate higher than the market equilibrium wage, which can lead to unemployment due to the excess supply of labor.

Minimum-Wage Laws

Legislation that sets the lowest hourly rate that employers are allowed to pay their workers.

Unions

Organizations formed by workers from related sectors to negotiate collectively with employers over wages, benefits, and working conditions.

Q11: Wyatt's current stock price is closest to:<br>A)$51.23.<br>B)$54.00.<br>C)$49.11.<br>D)$61.38.

Q21: Taggart's market capitalization is closest to:<br>A)$25 billion.<br>B)$31

Q25: If Flagstaff currently maintains a .5 debt

Q41: Which of the following statements is FALSE?<br>A)A

Q72: Which of the following statements is FALSE?<br>A)Although

Q77: The incremental unlevered net income in the

Q77: Calculate the effective tax disadvantage for retaining

Q88: Luther Industries has a market capitalization of

Q90: Because debtor-in-possession (DIP)financing is senior to all

Q101: Which of the following statements is FALSE?<br>A)Dividing