Use the table for the question(s) below.

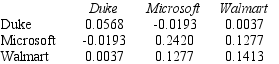

Consider the following covariances between securities:

-The variance on a portfolio that is made up of a $6000 investment in Duke Energy and a $4000 investment in Walmart stock is closest to:

Definitions:

Replication Initiation

The starting point of DNA replication in cells, where the double helix is first opened.

Lagging Strand

A strand of DNA that is synthesized as a series of short segments, called Okazaki fragments, which are then covalently joined by DNA ligase. Compare with leading strand.

Leading Strand

Strand of DNA that is synthesized continuously. Compare with lagging strand.

Okazaki Fragment

One of many short segments of DNA, each 100 to 1000 nucleotides long, that must be joined by DNA ligase to form the lagging strand in DNA replication.

Q4: Which of the following statements is FALSE?<br>A)Depreciation

Q6: Which of the following statements is FALSE?<br>A)The

Q20: The profitability index for project A is

Q28: Which of the following statements is FALSE?<br>A)Modigliani

Q32: The income that would be available to

Q67: Which of the following statements is FALSE?<br>A)In

Q77: Which pharmaceutical company faces less risk?

Q77: The market portfolio:<br>A)is underpriced.<br>B)has a positive alpha.<br>C)is

Q81: Suppose you plan to hold Von Bora

Q100: Consider an equally weighted portfolio that contains