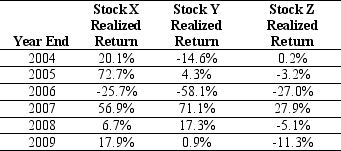

Use the table for the question(s)below.

Consider the following returns:

-Calculate the covariance between Stock Y's and Stock Z's returns.

Definitions:

Meta-Analysis

A set of statistical procedures for combining the results of a number of studies in order to provide a general assessment of the relationship between variables.

Narrative Literature Review

A comprehensive analysis and synthesis of published material on a specific topic, presented in a narrative format.

Failure To Replicate

The phenomenon where a study's findings cannot be reproduced under the same conditions, raising questions about the reliability of the original results.

Generalizable

Pertains to the ability of research findings to be applicable to broader populations or different contexts beyond the study sample.

Q4: Which of the following statements is FALSE?<br>A)The

Q7: Which of the following statements is FALSE?<br>A)The

Q14: Assume that you are an investor with

Q29: Luther's unlevered cost of capital is closest

Q33: Which of the following statements is FALSE?<br>A)To

Q50: The NPV profile graphs:<br>A)the project's NPV over

Q51: Which of the following statements is FALSE?<br>A)When

Q73: The value of currently unused warehouse space

Q100: Consider an equally weighted portfolio that contains

Q125: Which of the following statements is FALSE?<br>A)A