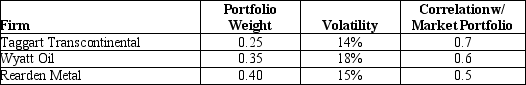

Use the following information to answer the question(s) below.  The volatility of the market portfolio is 10%,the expected return on the market is 12%,and the risk-free rate of interest is 4%.

The volatility of the market portfolio is 10%,the expected return on the market is 12%,and the risk-free rate of interest is 4%.

-The Sharpe Ratio for the market portfolio is closest to:

Definitions:

Vertical Integration

Organizational form in which a firm contains several divisions, with some producing parts and components that others use to produce finished products.

Monopoly Seller

A business entity that is the sole provider of a particular good or service, giving it significant control over the market price.

Marginal Cost Curve

A graphical representation showing how the cost of producing one additional unit of a good or service varies with the quantity produced.

Retail Coffee Price

The price at which coffee is sold to consumers in stores, cafes, or online platforms, reflecting the end cost including production, transportation, and markup.

Q38: Assume that investors in Google pay a

Q42: Which of the following statements is FALSE?<br>A)The

Q43: Calculate the total Free Cash Flows for

Q48: Assume that you purchased General Electric Company

Q80: Consider a zero-coupon bond with 20 years

Q81: Construct a simple income statement showing the

Q89: The value of Shepard Industries without leverage

Q90: Which of the following statements is FALSE?<br>A)The

Q92: What is the beta for a type

Q94: Which of the following statements is FALSE?<br>A)The