Use the following information to answer the question(s) below.

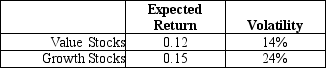

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The Sharpe ratio for the value stock portfolio is closest to:

Definitions:

Safety Devices

Tools or technologies designed to prevent accidents, injuries, or other hazardous outcomes in various environments.

Screen

To evaluate or assess something or someone in order to make a decision, often used in contexts like employment, investment, or healthcare.

Expected Loss

The anticipated amount of loss in an investment or insurance scenario, calculated by considering the probability and magnitude of possible losses.

Secure Neighborhood

A residential area that is well-guarded or designed with safety measures to protect residents and property.

Q7: Which stock has the highest total risk?<br>A)Merck

Q26: The volatility of the alternative investment that

Q50: The NPV profile graphs:<br>A)the project's NPV over

Q53: Wyatt Oil's average historical excess return is

Q57: Which of the following statements is FALSE?<br>A)The

Q64: The required net working capital in the

Q68: Assume that the Wilshire 5000 currently has

Q71: Assume that investors in Google pay a

Q89: If its managers engage in empire building,then

Q99: The expected return on the market portfolio