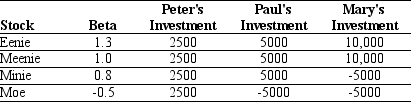

Use the table for the question(s) below.

Consider the following three individuals' portfolios consisting of investments in four stocks:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then the required return on Peter's portfolio is closest to:

Definitions:

Exhaust Valves

Components in an engine that open to allow exhaust gases to exit the combustion chamber after the power stroke.

DOHC

Stands for Dual Overhead Camshaft, a design in internal combustion engines where two camshafts are used to control the valves for improved performance.

Internal Combustion Engines

Engines that generate mechanical power by burning a fuel-air mixture within combustion chambers to create high-pressure gases that drive movement.

Intake

The part of an engine that draws air into the combustion chamber, sometimes referring more broadly to the system including air filters and intake manifolds.

Q6: Suppose that because of the large need

Q10: The internal rate of return (IRR)for project

Q48: Assume that you purchased General Electric Company

Q50: The NPV profile graphs:<br>A)the project's NPV over

Q51: Which of the following statements is FALSE?<br>A)When

Q55: Which of the following statements is FALSE?<br>A)Sensitivity

Q61: Given Nielson's current share price,if Nielson's equity

Q86: Ignoring the original investment of $5 million,what

Q87: Suppose that Defenestration decides to pay a

Q99: If Rockwood finances their expansion by issuing