Use the table for the question(s) below.

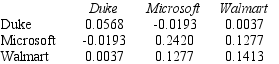

Consider the following covariances between securities:

-The variance on a portfolio that is made up of a $6000 investment in Duke Energy and a $4000 investment in Walmart stock is closest to:

Definitions:

Withdrawals

Amounts of money taken out from a business by its owners for personal use, reducing the owner's equity.

Parasympathetic Nerve

Nerves of the parasympathetic nervous system that help slow down the body's activity and allow the body to rest and digest.

Parasitic Worms

Organisms that live off of other organisms, causing harm to their hosts, and include species such as tapeworms, roundworms, and flukes.

Stomach Acid

The hydrochloric acid present in the stomach, essential for digestion and protection against pathogens.

Q7: Which of the following statements is FALSE?<br>A)The

Q8: Which of the following statements is FALSE?<br>A)A

Q14: Assume that you are an investor with

Q33: Which of the following statements is FALSE?<br>A)To

Q40: The required net working capital in the

Q49: Which of the following statements is FALSE?<br>A)Beta

Q53: Suppose you are a shareholder in d'Anconia

Q67: Which of the following statements is FALSE?<br>A)In

Q72: Which of the following statements is FALSE?<br>A)Expected

Q86: Which of the following statements is FALSE?<br>A)Many