Use the table for the question(s)below.

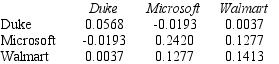

Consider the following covariances between securities:

-What is the variance on a portfolio that has $2000 invested in Duke Energy,$3000 invested in Microsoft,and $5000 invested in Walmart stock?

Definitions:

Dorsal Visual Streams

The brain pathway responsible for the processing of spatial location and movement, extending from the occipital to the parietal lobes.

Ventral Visual Streams

The pathway in the brain involved in object recognition and form representation, extending from the occipital lobe to the temporal lobe.

Simple Cortical Cell

A type of neuron in the visual cortex that responds maximally to specific edge orientations or moving bars of light.

Geniculostriate Pathways

The geniculostriate pathways are a part of the visual system responsible for processing visual information, extending from the retina to the primary visual cortex via the lateral geniculate nucleus.

Q8: The amount that Ford Motor Company will

Q27: Which of the following statements is FALSE?<br>A)About

Q34: The amount of incremental income taxes that

Q38: Which of the following statements is FALSE?<br>A)The

Q41: Which of the following statements is FALSE?<br>A)Problems

Q49: The level of incremental sales associated with

Q52: Wyatt's expected EPS in two years is

Q62: Your firm currently has $250 million in

Q66: What is the excess return for corporate

Q83: The market capitalization of d'Anconia Copper before