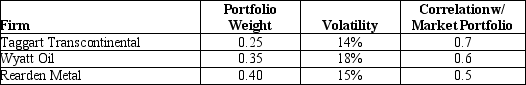

Use the following information to answer the question(s) below.  The volatility of the market portfolio is 10%,the expected return on the market is 12%,and the risk-free rate of interest is 4%.

The volatility of the market portfolio is 10%,the expected return on the market is 12%,and the risk-free rate of interest is 4%.

-The Sharpe Ratio for the market portfolio is closest to:

Definitions:

Honest

The quality of being truthful, straightforward, and free from deceit or fraud in one’s actions and statements.

Open

Characterized by accessibility, willingness to receive or consider new ideas, and lack of restrictions or barriers.

Johari Window

A model that helps individuals understand their relationship with self and others by categorizing known and unknown aspects of themselves in four quadrants.

Bottom-Right Pane

In a graphical user interface, the section or area located at the bottom-right part of the window or screen, often containing specific additional information or controls.

Q23: If the market risk premium is 6%

Q24: Which of the following statements regarding portfolio

Q32: The free cash flow from the Shepard

Q33: Which of the following statements regarding profitable

Q48: Which of the following is TRUE of

Q58: Using the FFC four factor model and

Q68: The decision you should take regarding this

Q72: The incremental after-tax cash flow that Krusty

Q93: Which of the following statements is FALSE?<br>A)If

Q112: Assuming that Tom wants to maintain the