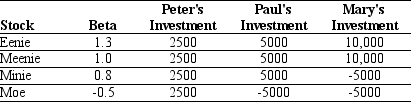

Use the table for the question(s) below.

Consider the following three individuals' portfolios consisting of investments in four stocks:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then the required return on Peter's portfolio is closest to:

Definitions:

Incentive Contracts

Contracts designed to align the interests of parties by providing rewards based on performance.

Shirking

The behavior of avoiding or neglecting responsibilities, typically in the context of employment or duties.

Monitoring

The process of systematically observing, checking, and recording activities or data for a specific purpose, often used in contexts of quality control, surveillance, or tracking.

Moral Hazard

The risk that one party to a transaction might engage in behavior that is undesirable from the other's standpoint, because the latter cannot effectively control such behavior.

Q11: Wyatt's current stock price is closest to:<br>A)$51.23.<br>B)$54.00.<br>C)$49.11.<br>D)$61.38.

Q14: You currently own $100,000 worth of Walmart

Q16: Which of the following statements is FALSE?<br>A)The

Q26: Assume that Casa Grande Farms is planning

Q43: What are some common multiples used to

Q44: Suppose that you are holding a market

Q50: You currently own $100,000 worth of Walmart

Q54: Calculate the interest tax shield,the total amount

Q91: Suppose that you borrow only $45,000 in

Q103: Suppose that you want to use the