Use the table for the question(s)below.

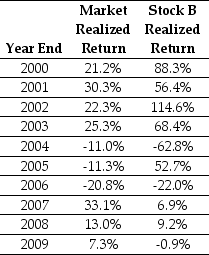

Consider the following realized annual returns:

-Suppose that you want to use the 10-year historical average return on Stock B to forecast the expected future return on Stock B.Calculate the 95% confidence interval for your estimate of the expected return.

Definitions:

Offeror

An offeror is the party in a contract who makes an offer to enter into an agreement with another party, known as the offeree.

Offer Immediately

This term typically refers to a proposal or opportunity presented without delay.

Reasonably Definite Terms

A principle that a contract must be clear enough in its terms so that the obligations of each party can be understood and enforced.

Offer

A key factor in the agreement element of a contract; consists of the terms and conditions set by one party, the offeror, and presented to another party, the offeree.

Q3: The beta for the risk-free investment is

Q4: Assuming that Dewey's cost of capital is

Q24: Assuming that you have made all of

Q41: Suppose that you borrow $60,000 in financing

Q45: Assume that MM's perfect capital market conditions

Q65: Suppose the risk-free interest rate is 4%.If

Q66: Which of the four bonds is the

Q73: The value of currently unused warehouse space

Q74: Following the borrowing of $12 million and

Q85: The Market's average historical excess return is