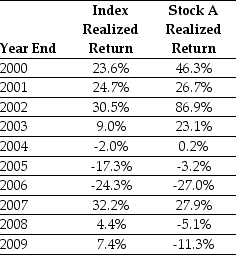

Use the table for the question(s) below.

Consider the following realized annual returns:

-Suppose that you want to use the 10-year historical average return on the Index to forecast the expected future return on the Index.The standard error of your estimate of the expected return is closest to:

Definitions:

Comparative Advantage

An economic theory that describes how a country or entity can produce goods and services at a lower opportunity cost than others.

International Trade

Trading goods, services, and capital across borders or territories between countries.

World Price

The international market price of a good or service, determined by global supply and demand.

Q7: The beta for Sisyphean's new project is

Q16: Using the FFC four factor model and

Q44: The forward rate for year 3 (the

Q52: Which of the following statements is FALSE?<br>A)The

Q59: Which of the following statements is FALSE?<br>A)The

Q61: Which of the following statements is FALSE?<br>A)The

Q61: Which of the following statements is FALSE?<br>A)A

Q64: A 4-year default-free security with a face

Q90: The risk premium for "Meenie" is closest

Q97: The number of shares that Galt must