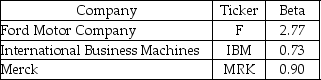

Use the following information to answer the question(s) below.

-If the risk-free rate is 5% and the expected return of investing in Merck is 11.3%,then the expected return on the market must be:

Definitions:

Price Level

An index that measures the average of current prices across the entire spectrum of goods and services produced in the economy.

Interest Rate

The amount charged by a lender to a borrower for the use of assets, expressed as a percentage of the principal, usually on an annual basis.

Money-Demand Curve

Illustrates the relationship between the quantity of money people want to hold and the interest rate, showing how changes in the interest rate affect the demand for money.

Federal Reserve

The central banking system of the United States, responsible for implementing the country's monetary policy and regulating its financial institutions.

Q19: The volatility of your investment is closest

Q26: Which of the following statements is FALSE?<br>A)Bond

Q35: Which of the following statements is FALSE?<br>A)In

Q41: Which of the following statements is FALSE?<br>A)Problems

Q46: Assume that your capital is constrained,so that

Q48: The present value of an investment that

Q58: NoGrowth industries presently pays an annual dividend

Q70: Suppose that Defenestration decides to pay a

Q76: Taggart Transcontinental has a dividend yield of

Q90: Consider the following timeline detailing a stream