Use the information for the question(s) below.

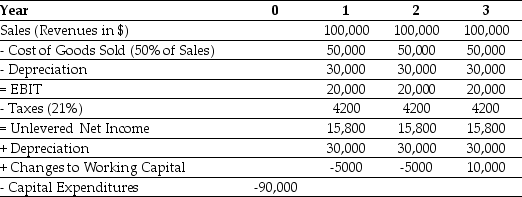

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projections:

-The free cash flow for the first year of Epiphany's project is closest to:

Definitions:

Fair Value

An estimate of the market value of an asset or liability based on current market conditions and willing buyer and seller dynamics.

Held-to-Maturity Debt Securities

Financial instruments that a firm has the intent and ability to hold until they mature, recorded at amortized cost.

Marketable Securities

Financial instruments that are easily convertible to cash and are subject to minimal price risk.

Amortized Cost

The amount at which a financial asset or liability is measured at initial recognition minus principal repayments, plus or minus the cumulative amortization using the effective interest method.

Q26: Consider a portfolio that consists of an

Q51: Suppose you will receive $500 in one

Q56: If the current inflation rate is 5%,then

Q68: Assume that the Wilshire 5000 currently has

Q96: Suppose that you are holding a market

Q100: Consider an equally weighted portfolio that contains

Q100: The standard deviation of the overall payoff

Q115: Which of the following statements is FALSE?<br>A)Investors

Q127: Which of the following statements is FALSE?<br>A)The

Q132: Explain how having different interest rates for