Use the information for the question(s) below.

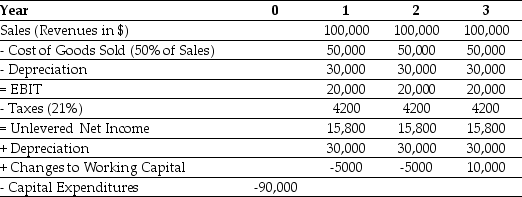

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projections:

-The NPV for Epiphany's Project is closest to:

Definitions:

Asset

Resources owned by a company or individual with economic value or future benefit, such as cash, inventory, property, and equipment.

Asset Subgroups

Categories within a company's assets that are grouped based on similar characteristics or functions, such as fixed assets, current assets, or intangible assets.

Classified Balance Sheet

A financial statement that organizes assets, liabilities, and equity into subcategories for more detailed analysis.

Current Assets

Assets that are expected to be converted into cash, sold, or consumed within one year or during the normal operating cycle.

Q33: If you sell this bond now,the internal

Q47: If the current rate of interest is

Q52: If Krusty Krab's opportunity cost of capital

Q58: NoGrowth industries presently pays an annual dividend

Q64: According to a survey of 392 CFOs

Q66: Wyatt Oil presently pays no dividend.You anticipate

Q67: A three-month treasury bill sold for a

Q82: Suppose that Monsters' expected return is 12%.Then

Q84: Which of the following statements is FALSE?<br>A)Because

Q99: Luther's weighted average cost of capital is