Use the information for the question(s)below.

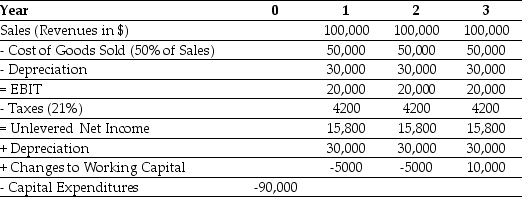

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projections:

-Epiphany would like to know how sensitive the project's NPV is to changes in the discount rate.How much can the discount rate vary before the NPV reaches zero?

Definitions:

Price Discrimination

Charging different prices to different consumers for the same good.

Price Fixing

An illegal agreement among competitors to set, raise, or lower prices to predetermined levels, thereby undermining free market competition.

Deadweight Loss

A loss in economic efficiency that can occur when equilibrium for a good or service is not achieved or is not achievable.

Price Ceiling

A government-imposed limit on how high the price of a product can be, intended to protect consumers from high prices.

Q2: If the risk-free interest rate is 10%,then

Q4: Wyatt Oil is contemplating issuing a 20-year

Q6: The payback period for project Alpha is

Q8: Which of the following statements regarding the

Q20: The effective annual rate on your firm's

Q34: The Sharpe ratio for the efficient portfolio

Q64: Assume that you purchased J.P.Morgan Chase stock

Q70: If the interest rate is 7%,the alternative

Q81: The payback period for project B is

Q94: Which of the following statements is FALSE?<br>A)The