Use the information for the question(s)below.

Kinston Industries is considering investing in a machine that will cost $125,000 and will last for three years.The machine will generate revenues of $120,000 each year and the cost of goods sold will be 50% of sales.At the end of year three the machine will be sold for $15,000.The appropriate cost of capital is 10% and Kinston is in the 21% tax bracket.

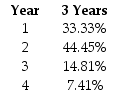

-Assume that Kinston's new machine will be depreciated using MACRS according to the following schedule:  What is the NPV of this project?

What is the NPV of this project?

Definitions:

Limestone

A sedimentary rock composed primarily of calcite or dolomite, widely used in construction and manufacturing.

Calcium Carbonate

A naturally occurring compound found in rocks, shells, and marine organisms, used widely in the manufacturing and construction industries.

Microorganisms

Microorganisms are microscopic living organisms, including bacteria, viruses, fungi, and protozoa, that can exist as single cells or cell clusters.

Conglomerate

A coarse-grained sedimentary rock composed of rounded fragments or clasts of pre-existing rocks bound together by a matrix of finer particles and cement.

Q9: Suppose you plan to hold Von Bora

Q14: Which of the following statements is FALSE?<br>A)Finding

Q25: Which of the following is NOT a

Q34: Assume that the ETF is trading for

Q48: You are considering using the incremental IRR

Q60: Nielson Motors has a share price of

Q65: The required return on the precious metals

Q79: The firm's unlevered (asset)cost of capital is:<br>A)the

Q81: The credit spread on BBB-rated corporate bonds

Q119: Suppose that California Gold Mining's expected return